-

Nossos Produtos

Mobile Computers

Product ModelComputador móvel

Sistema operacional Android mais avançado, design de teclado mais flexível, nível de proteção e vida útil da bateria mais fortes.

Coletor de dados

Mais poderoso, mais extensível, mais avançado em todas as maneiras.

Mobile Computer

Easy and Flexible Data Entry, Remarkable Data Capture Performance

Computador móvel

Mais fácil de usar, mais econômico, robusto e durável

Computação móvel

5G · Android 12 · IP67

Computador Móvel

Performação poderosa. Mais duradoura e eficaz em custo.

Coletor de dados

Excelente desempenho, funções versáteis habilitadas

Handheld Computer

Ultra Thin & Light, Rugged Enough to Use Anywhere

Thermometry Mobile Data Terminal

High Precision Temperature Measurement in One Second

Mobile Computer with Printer

Shining Modern Body, Mobile Efficient Printing

Coletor de Dados

Resistente e Portátil Com Alta Desempenho

Handheld RFID Readers

Product ModelUHF RFID Scanner

Desempenho UHF poderoso e 1D/2D

UHF RFID Reader (Android 11/13)

Desempenho UHF mais forte, maior segurança e confiabilidade

Leitor RFID embutido

O leitor RFID portátil compacto e leve

Leitor UHF RFID

Desempenho RFID líder de mercado

Leitor R6 UHF RFID

Poderosa leitura e escrita de UHF

Leitor RFID Bluetooth

Excelente capacidade UHF

Leitor de UHF RFID

Leve e portátil, Capacidade UHF superior

Leitores RFID Bluetooth

Product ModelUHF RFID Scanner

Desempenho UHF poderoso e 1D/2D

Wearable RFID Reader

Leitura e gravação RFID robustas

Leitor R6 UHF RFID

Poderosa leitura e escrita de UHF

Leitor RFID Bluetooth

Excelente capacidade UHF

Leitor vestível BT RFID

Leitura e Escrita RFID Robusta

Leitor RFID de Mesa

Leitura profissional de RFID de curto alcance, personalizada para aplicativos de desktop

Rugged Tablets

Product ModelTablet Industrial

Tela 8'' & bateria 8000mAh, Abundantes Funções

Tablet RFID

Melhor Desempenho de Leitura de RFID da Categoria

Biometric Readers

Product ModelScanner de impressões digitais

Mais Poderoso, Mais Extensível, Mais Avançado em todos os sentidos

Biometrics

Accurate Fingerprint Reading and Facial Recognition

Leitores RFID fixos

Product ModelLeitor RFID fixo (Android 11)

Sistema operacional Android 11, múltiplas interfaces, desempenho RFID UHF mais poderoso

Leitor RFID de Mesa

Leitura profissional de RFID de curto alcance, personalizada para aplicativos de desktop

Impressoras

Product ModelImpressora de códigos de barras

Excelente impressão de código de barras, eficiente e fácil de operar

Impressora RFID

Impressão poderosa de RFID e código de barras, rápida e altamente segura

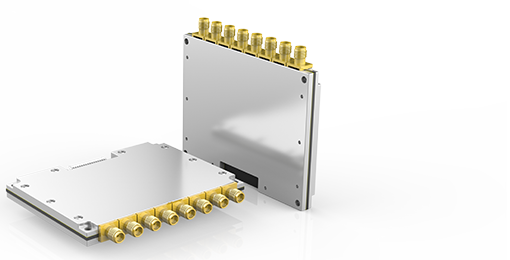

UHF RFID Modules

Product ModelUHF RFID Module

Reading with High Rate and Long Range

Módulo UHF RFID

Mais Rápido Para Ler Multi Etiquetas

UHF RFID Module

Reading Tags with Wider Range

UHF RFID Module

Reading Tags with Wider Range

Vehicle-mounted Computers

Product ModelVehicle Computer

Enable Flawless Fulfillment

-

Indústrias

Logística

Chainway handheld computer gives you added visibility and increased fle...

Varejo

Chainway retail solution solves existing issues faced by retailers with...

Assistencia Médica

Chainway mobile healthcare PDA captures accurate healthcare data in rea...

Finanças

Chainway banking solution enables administrators to have real-time moni...

Armazenagem

Chainway makes your warehouse connected and smart with its barcode/RFID...

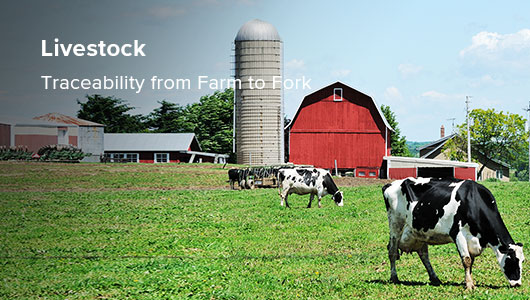

Pecuária

With Chainway PDAs, an errorless electronic profile of each animal is a...

Energia

Chainway PDAs integrated with custom-made function modules realize auto...

- Cases de Sucesso

- Nossos Parceiros

- Suporte

- Sobre a empresa